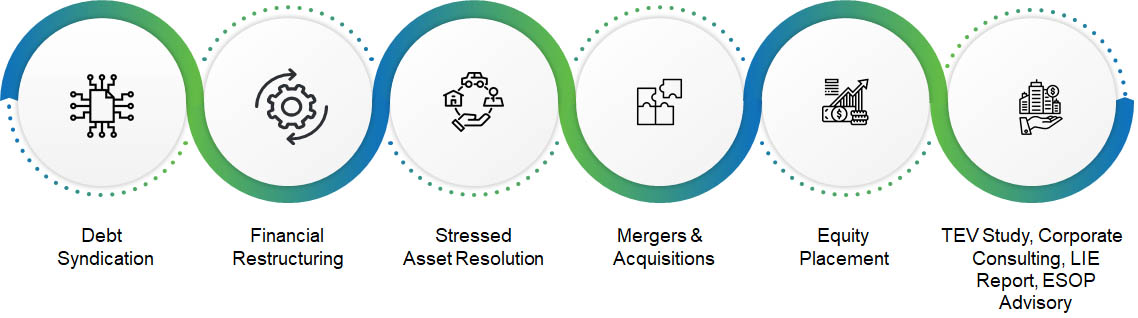

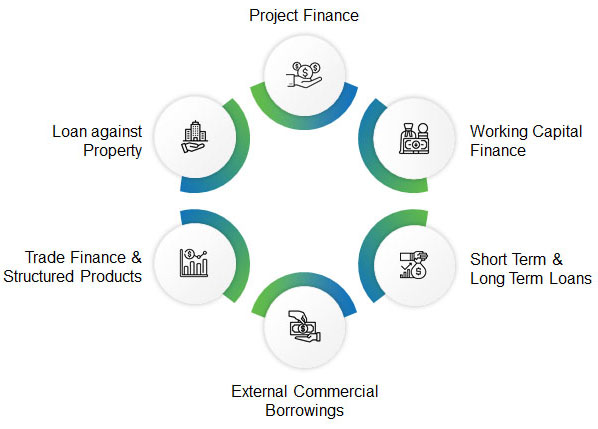

Our expertise lies in identifying project funding avenues that are both timely and economical. Our teams of experts study the options available which include Structured Finance, Trade Finance, Short or Long Term Funds, Equipment Finance or any other financing option to devise the most beneficial route for our clients. We meticulously design the most beneficial path for our clients, supervising the entire process from Capital Structuring, Feasibility Study, Project Appraisal, and Fund Sourcing.

We provide economically viable structural solutions by leveraging our understanding of the current investment landscape and a deep understanding of specific requirements. Our knowledge of the current investment scenario and understanding of specific needs enables us to deliver cost-competitive structural solutions. Our long-term association with Banks and Bankers gives us a special edge in arranging efficient negotiations and favourable terms, particularly in Loan Syndication.

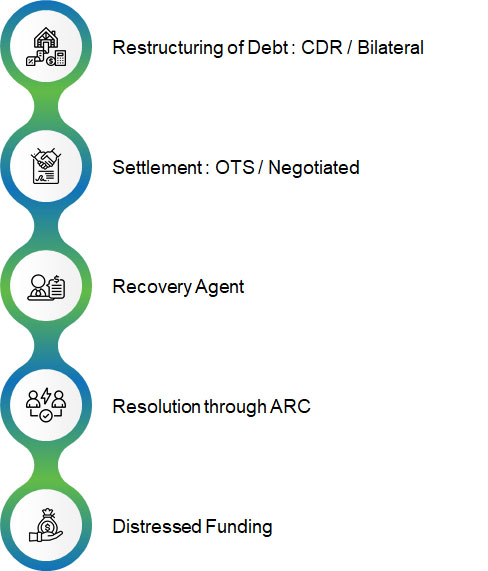

The opening up of the Indian Economy to global competition makes the optimization of financial resources a critical and continuous task. A major challenge for many Companies is the problem of Stressed Financial Assets. Our experience in providing comprehensive solutions for Asset Reconstruction and Recapitalization is therefore highly appreciated. We assist Companies in restructuring their capital structure, negotiate with lenders for settlement of restructured loans, reschedule debt to lower interest costs and extend the repayment period. In extreme cases we also arrange Mergers and Takeovers of stressed Companies.

In response to the Reserve Bank of India's (RBI) increased emphasis on improving asset quality and capital adequacy, a distinct trend is emerging within the banking and financial sector. This trend is characterized by a significant shift in focus toward the meticulous management of Non-Performing Assets (NPAs). Sumedha Fiscal is a seasoned player in this context, with the necessary experience, specialized skill sets, and a steadfast focus on facilitating the adept resolution and settlement of loans.

Our extensive experience in Restructuring Debts (CDR/Bilateral), OTS, Resolution through ARCs, and arranging Distressed Funding enables us to navigate the complex landscape of Non-Performing Assets with ease. We are honoured to have been appointed as a Recovery Agent by major banks and prestigious financial institutions.

At Sumedha Fiscal, we have decades of combined experience in Mergers, Acquisitions, Amalgamation, and Spin-offs, across all sectors in India and overseas. We specialize in value-centric research and the identification of strategic business alliances, which are essential components of a successful M&A transaction. Furthermore, we make recommendations for economically and financially sustainable ventures while coordinating critical technical and financial partnerships. Additionally, we extend indispensable support in the thorough crafting of essential project documentation, conducting due diligence, performing valuations (fairness opinions), and securing essential regulatory approvals for the transaction.

We possess a wealth of experience in assisting prospective buyers and sellers:

- Spotting potential business collaborators, proposing economically feasible projects, and organizing both technical and financial partnerships

- Due Diligence

- Deal Structuring and Negotiation

- Valuation and Fairness Opinion

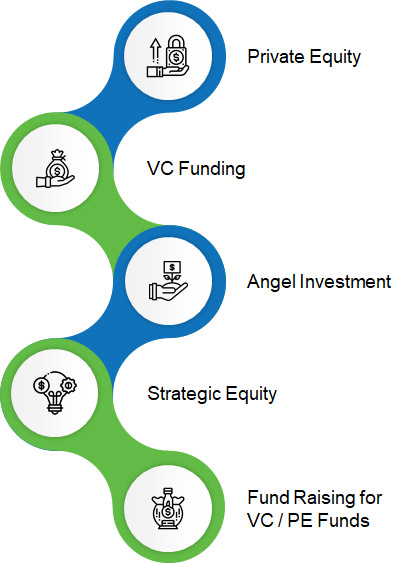

At Sumedha Fiscal, we excel in providing comprehensive assistance to our clients in arranging Private Equity and Venture Capital Financing. Aside from that, we provide Equity Financing solutions tailored to suit the unique needs of both Corporates and Entrepreneurs. Our expertise spans the entire spectrum, whether it's securing Seed Capital for innovative startups, facilitating Early-Stage funding to fuel growth, or enabling Late-Stage Financing to solidify market presence.

At Sumedha Fiscal we offer a full range of services covering the whole process of Private Equity fundraising. Our approach involves identifying the best funding opportunities and constructing compelling proposals that resonate with potential investors. We conduct meticulous valuation exercises to ensure that financial propositions are in line with market realities.

What distinguishes us is our dedication to fostering genuine collaborations. We actively seek out and engage with investors who share our clients' visions. Our involvement extends all the way to the end, as we work tirelessly toward deal closure, transforming possibilities into profitable realities.

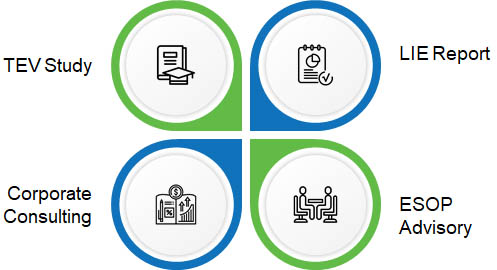

Techno-Economic Viability (TEV) Study

Sumedha Fiscal conducts a thorough examination of the technical and economic feasibility of projects, fulfilling the prerequisites set forth by lenders such as banks, financial institutions, and ARCs. Our adept team possesses the requisite expertise and methodologies to meticulously perform technical and commercial appraisals, ensuring a comprehensive assessment.

Lenders Independent Engineers (LIE) Report

Sumedha Fiscal works closely with lenders to furnish impartial technical due diligence reports (LIE Reports) essential for the monitoring and evaluation of sanctioned projects. We hold empanelment with esteemed banks and financial institutions, positioning us as a trusted provider of LIE Reports.

ESOP Advisory

Employee Stock Option Plans (ESOPs) and various other forms of share-based compensation benefits, often collectively referred to as ESOPs, stand out as crucial instruments for attracting, motivating, and retaining valuable employees. Sumedha Fiscal provides ESOP Advisory services, which include the design and implementation of share-based compensation benefits for corporate employees.

Corporate Consulting

Sumedha Fiscal provides an extensive array of corporate consulting services, spanning diverse areas such as Business Restructuring, Establishment of Joint Ventures, Formulation of India Entry Strategies, Global Business Expansion, Collaborative Partnerships, Product and Market Extension, as well as Facilitation of Liaison Activities.